rsu tax rate us

For high earners the capital gains tax rate is anywhere from 188 to 238. Capital gains tax is imposed on profit - the increase in value as a result of appreciation.

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

This means that in addition to paying the normal 40 tax you also pay an additional 20 tax on income that was previously tax-free resulting in a total tax rate of 60.

. RSUs are not taxable when they are granted. To use the RSU projection calculator walk through the following steps. Income Tax Rate Indonesia.

First of all RSUs are different than restricted stocks. Most companies will withhold federal income taxes at a flat rate of 22. Basic Info for RSU Calculator.

The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax yourself and receive all the sharesbut most people will opt to have shares deducted to pay for these deductionsSo if you are a higher rate tax payer you will be due to pay 42 tax and NI which would mean your 50 shares would be netted. Employers will usually deal with this under PAYE and so if you are the recipient of some RSUs initially there is nothing you need to do to make that happen. Ordinary Income Tax.

Some RSU receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck. The total is 108000 and each increment is taxable on its vesting date as compensation income when the shares. Essex Ct Pizza Restaurants.

This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers. When you become vested in your stock its fair market value gets taxed at the same rate as your ordinary income. For every 2 you earn above 100000 your Personal Allowance is reduced by 1.

Estimate how much your RSU value will increase per year. Op 23 days ago. Taxation of RSUs.

Opry Mills Breakfast Restaurants. Soldier For Life Fort Campbell. Its important to remember that the RSU tax rate will be the same as your income tax rates.

Choose Avalara sales tax rate tables by state or look up individual rates by address. 514-393-5554 The Canada Revenue Agency CRA has issued new commentary 1 with respect to taxation of restricted stock units RSUs. Now that you know the basics of how RSUs work you can now confidently use the RSU.

Decide on your strategy. Vesting Schedule Hypothetical Future Value Per Share. The exact tax rate will depend on your specific tax bracket as determined by your income.

So its up to you to enter a percentage. You can avoid paying this 60 tax charge by making a pension contribution. RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax.

As a CDN tax resindet you will always be taxed with CDN tax rates. Long-term capital gains are taxed at a special lower rate. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

Capital gains tax is imposed only if the stockholder holds on to the shares and they appreciate in value before being sold. Rsu Tax Rate Us. This is known as the 60 tax trap.

Pay next years state income tax and. Consideration paid by Claire. Step 4 - Edit State Tax Rate Assumption.

RSUs are taxed at ordinary income rates when issued typically after vesting. The value of over 1 million will be taxed at 37. For most people the tax rate on long-term capital gains is 15.

Using the RSU Projection Calculator. Delivery Spanish Fork Restaurants. Ad Download Avalara sales tax rate tables by state or search tax rates by individual address.

23 days ago. At any rate RSUs are seen as supplemental income. The beauty of RSUs is in the simplicity of the way they get taxed.

This week I will list six things that I think you need to know about your RSUs. The RSUs you get will be taxed about half de to it being income and when you sell capital gains whether you sell form the US or Canada. 1 At the time of vesting and 2 At the time of sale.

This is known as the 60 tax trap. There is only a one-word difference in the name but they. For your state tax rate itd be a little much for us to pull each states income tax and include it.

A restricted stock unit RSU is a form of compensation issued by an employer to an employee in the form of company shares. RSUs can trigger capital gains tax but only if the stock holder chooses to not sell the stock and it increases in value before the stock holder sells it in the future. Market value of shares.

Claires tax on the RSU vest. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

Unlike the much more complicated ESPP they get taxed the same way as your income. An RSU is a grant valued in terms of company stock but company stock is not issued at the time of the grant. Marginal Federal Tax Rate You can use the 2020 brackets below to estimate your tax bracket Marginal State Tax Rate.

A big note here you must enter a value even if the value is 0. The loss from the sale of shares can be carried forward up to 5 years. Because there is no actual stock issued at grant no Section 83 b election is permitted.

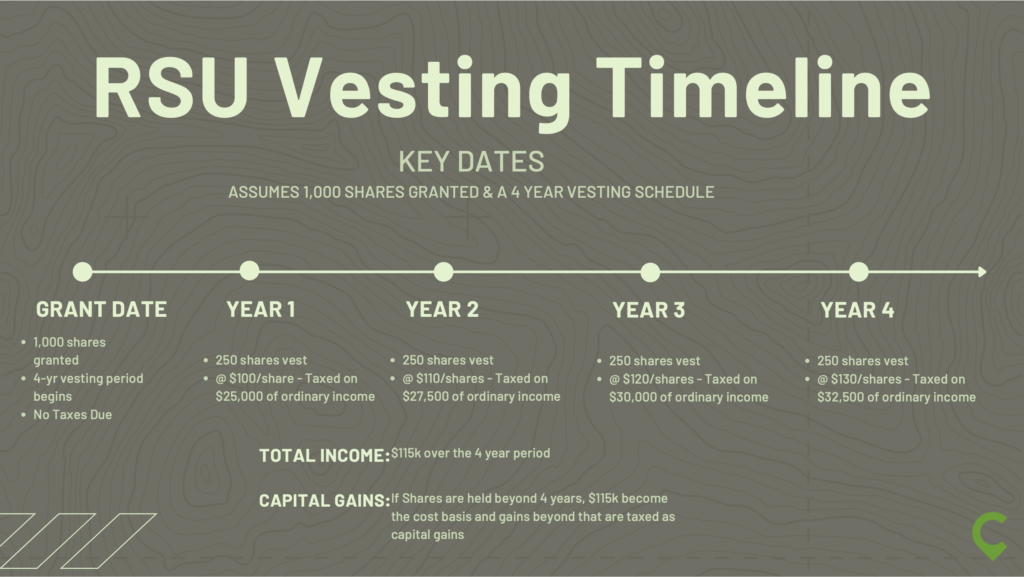

The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent for the exceeding part. Restricted stock units are issued to an employee through a vesting plan and distribution schedule after achieving required performance milestones or upon remaining with their employer for a particular length of time. The stock price at vesting in year one is 20 1000 x 20 20000 of ordinary income at year two 25 25000 at year three 30 30000 and at year four 33 33000.

If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate. RSU Tax Rate. Some states have capital gains tax as well.

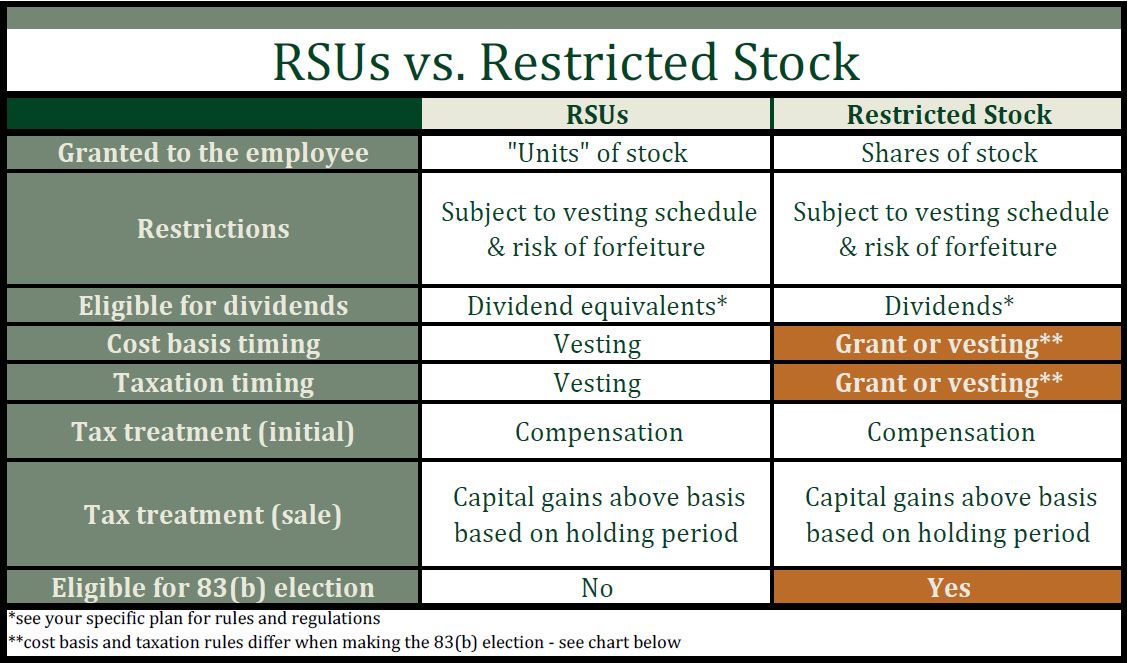

Input your current marginal tax rate on vesting RSUs. Restricted Stock Units vs. What is the tax rate for an RSU.

The taxation of RSUs is a bit simpler than for standard restricted stock plans. The first time that they are exposed to tax is upon vesting at which time both income tax and NIC are due. On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers.

Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. Restaurants In Matthews Nc That Deliver. If youre a single filer with 175000 taxable income youre at a 32 marginal tax rate.

Enter the amount of your new grant - whether an offer grant or an annual refresh. Restricted stock unit RSU is probably one of the most common types of stock compensations nowadays. Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent.

You receive 4000 RSUs that vest at a rate of 25 a year and the market price at grant is 18.

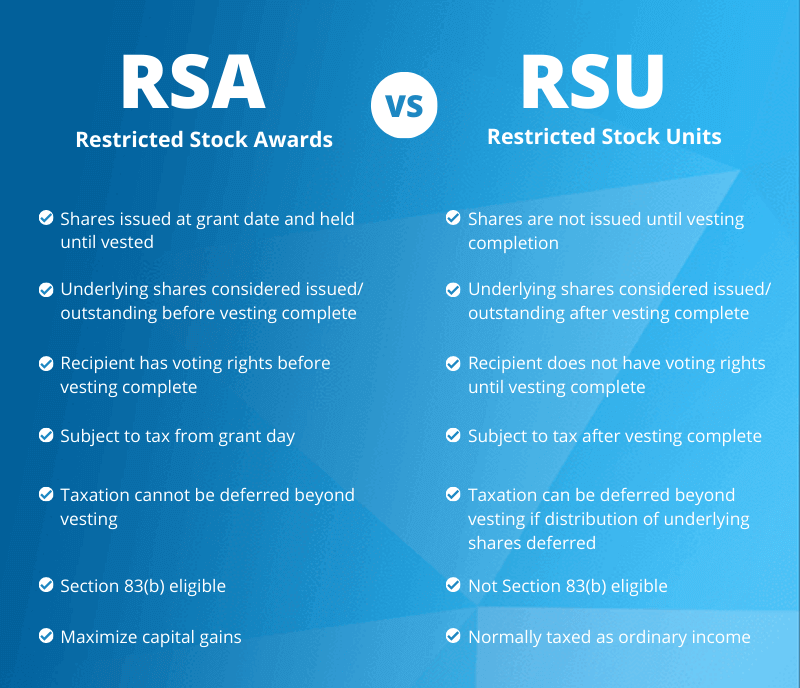

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

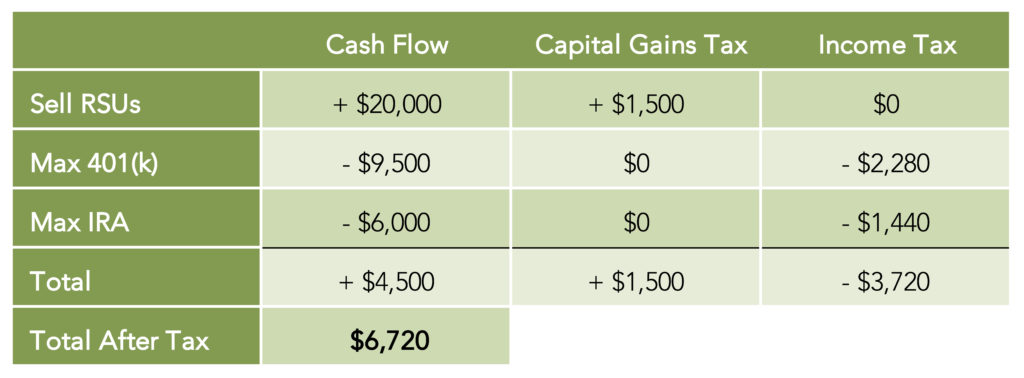

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Of Mnc Perquisite Tax Capital Gains Itr

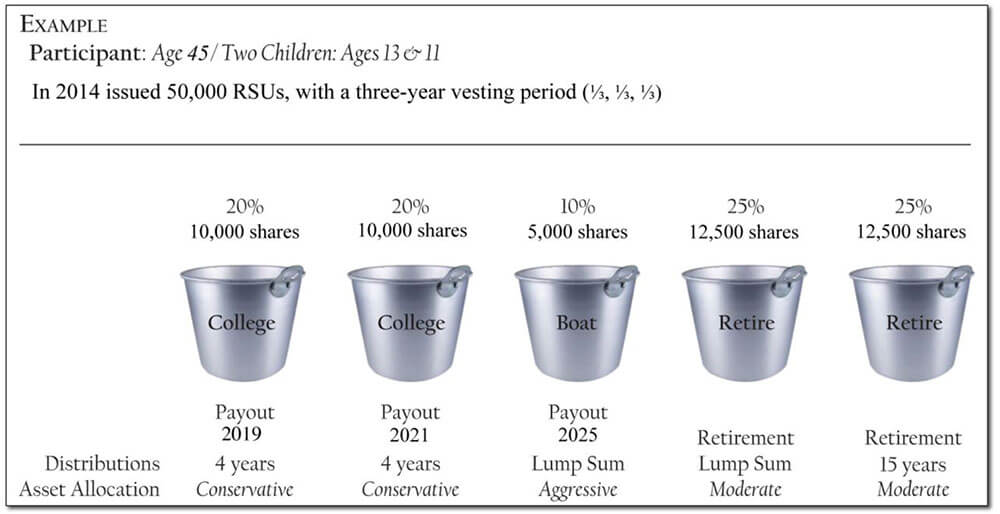

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Rsa Vs Rsu All You Need To Know Eqvista

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners

Rsu Tax Rate Is Exactly The Same As Your Paycheck

A Tech Employee S Guide To Rsus Cordant Wealth Partners

Rsu Taxes A Tech Employee S Guide To Tax On Restricted Stock Units Ageras

Restricted Stock Units Jane Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana